In the first quarter, the total amount of loans grew steadily and rapidly, and the scale of new social financing was at a higher level in the same period in history.

CCTV News:The State Council Press Office held a press conference on April 18th. In the first quarter, RMB loans of financial institutions increased by 9.5 trillion yuan. What areas were these funds mainly invested in? The person in charge of relevant departments of China People’s Bank made an analysis.

Zhang Wenhong, head of the Survey and Statistics Department of the People’s Bank of China, said that the total loans in the first quarter continued to grow steadily and rapidly. From the perspective of industry investment, new loans are mainly invested in key areas such as manufacturing, infrastructure and service industries, and the growth rate of real estate loans has also rebounded. The investment structure of the loan industry continued to be optimized.

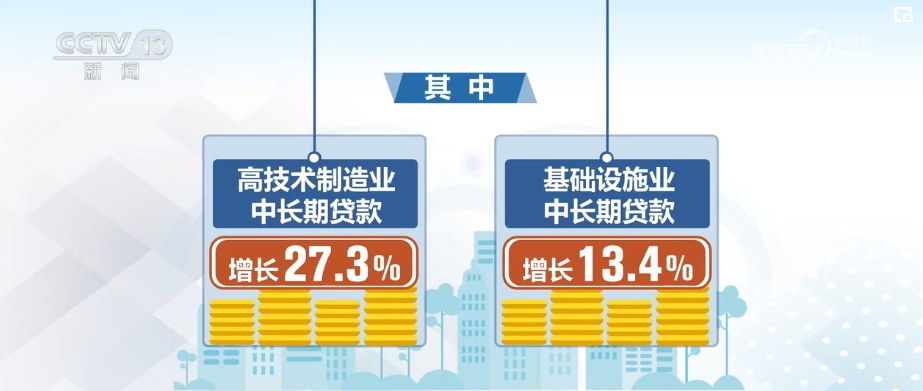

At the end of March, the medium and long-term loans of manufacturing industry increased by 26.5%, among which the medium and long-term loans of high-tech manufacturing industry increased by 27.3%; Medium and long-term loans in infrastructure industry increased by 13.4%; The medium and long-term loans of service industry excluding real estate industry increased by 13.1%, which was significantly higher than the total loan growth rate of 9.6%. The growth rate of medium and long-term loans in the real estate industry has increased. At the end of March, the medium and long-term loans in the real estate industry increased by 4.9%, 0.6 percentage points higher than the end of last year.

The data shows that in the first quarter of 2024, the interest rate of Pratt & Whitney small and micro loans continued to decline while increasing by 20.3%.

The scale of new social financing is still at a relatively high level in the same period of history.

In the first quarter of 2024, the scale of social financing increased by 12.93 trillion yuan, a year-on-year decrease of 1.61 trillion yuan. Does this mean that financial support for the real economy has decreased? At the press conference, the relevant person in charge of China People’s Bank responded to this.

Zhang Wenhong introduced that in the first quarter, the scale growth of social financing basically matched the expected target of economic growth and price level in 2024, especially the growth of around 8.7% based on the high base in 2023 is not low. From the same period of history, in the first quarter of 2024, the increase of social financing scale was still at a high level in the same period of history.