Global news: US stocks are approaching the technical bull market, and people are paying attention to the Apple Developers Conference tonight.

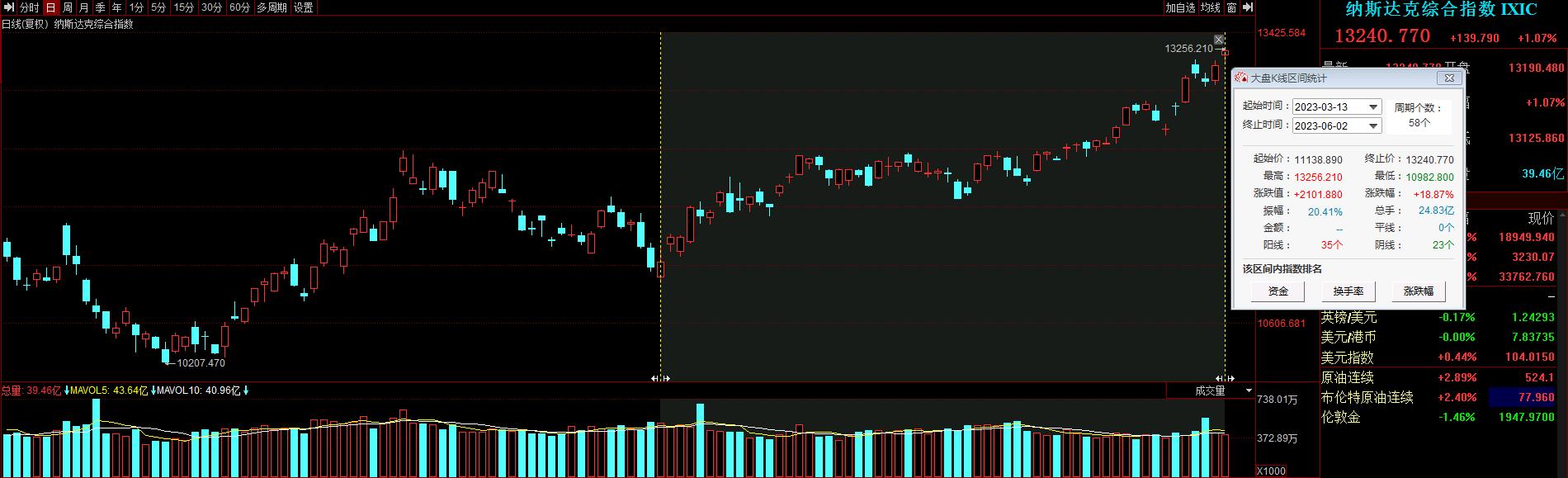

On June 5th, it was reported that the risk of US debt default has been eliminated with Biden’s signing of the debt ceiling bill, and the Federal Reserve’s suspension of interest rate hike in June has been basically priced. Last week, the risk appetite of the US stock market obviously picked up, and the three major indexes rose across the board. The Nasdaq has risen nearly 19% from the low point in March, approaching the technical bull market.

However, as the rally led by this round of technology stocks continues for a long time, the market needs to worry about whether it can continue, whether it should cash out or wait and see.

The Nasdaq 100 index, which is dominated by technology stocks, has risen by 33% in 2023. Some analysts have pointed out that the AI ? ? craze began to remind them of the Internet era in 2000. Others pointed out that technology stocks are particularly sensitive to interest rate expectations, and if inflation does not subside quickly, these expectations will cause problems.

This returns to the Fed’s monetary outlook. Due to the exceptionally strong non-agricultural sector in May last week, the Fed’s expectation of raising interest rates by 25 basis points at the July meeting has been fully priced. Therefore, even if the interest rate hike is suspended in June, the trend of continuing to tighten still exists. Investors need to make a good balance between inflation and the continued fermentation of the AI ? ? trend.

It is particularly noteworthy that the global focus on Apple’s 2023 Developer Conference tonight, in addition to the highly anticipated MR head show, the market also expects whether Apple will bring surprises to the market in the relatively backward AI wave.

Guo Ming, a well-known Apple analyst, also wrote that investors are more concerned about Apple’s artificial intelligence (AI) related business. If Apple’s AR/MR headset is released successfully, it will have a great impact on 3D interactive design and 3D computer images (just like ChatGPT has on AI/AIGC). In the long run, the key factor for the success of Apple’s AR/MR headset is whether it can be highly integrated with AI/AIGC. If Apple announces the launch of AI or AIGC services at WWDC, it will help to continue the current AI investment enthusiasm. If Apple has higher hardware specifications for AIGC, it may also drive the growth of hardware replacement demand.

In other respects, the results of the OPEC+ meeting were hard to come by. Saudi Arabia voluntarily reduced production by an additional 1 million barrels in July, which may be extended. OPEC+’ s previously announced production reduction plan was extended to 2024. International oil prices rose by more than 3% at the opening.

[Market Review]

Last week, the Dow rose 2.02%. The Nasdaq rose 2.04%, recording the sixth consecutive week of gains. The S&P 500 index rose 1.83%, the third consecutive week of gains.

[One-week preview]

[News of Zhou]

Saudi Arabia announced an additional oil production reduction of 1 million barrels per day in July, and OPEC+ the existing production reduction was extended to 2024.

The result of OPEC+ meeting was hard to come out. Saudi Arabia voluntarily reduced production by an additional 1 million barrels in July, which may be extended. OPEC+’ s previously announced production reduction plan was extended to 2024. The United Arab Emirates has become the biggest winner of this meeting-the quota will be increased next year, and the quotas of some African countries will be reduced, making the quotas consistent with their production capacity.

Zelensky: Ukraine is ready to launch a counterattack.

According to CCTV news, Ukrainian President Zelensky said in an interview that he was ready to launch a counterattack. Zelensky said that although Ukraine hopes to acquire more types of weapons, the country can’t wait for several months to launch a counterattack. He stressed that the Patriot air defense system is very important, and Ukraine needs at least 50 such systems, otherwise it will lose its air superiority, which is very dangerous for any counterattack.

Earlier, Russian Deputy Foreign Minister Galuzin once said that the so-called "counterattack" instigated by western countries in Ukraine once again showed that they ignored the disastrous consequences that Ukraine and its residents might encounter. Western countries tried to push the conflict to the point of "the last Ukrainian".

The United States created 339,000 jobs in May, far exceeding expectations, but the unemployment rate unexpectedly hit a new high in October.

In May, the United States created 339,000 non-agricultural jobs, almost twice the estimated median of 195,000, the largest increase since January 2023. The unemployment rate in May was 3.7%, higher than the previous value of 3.4% and the expected 3.5%, setting a new high since October 2022. The new jobs far exceeded expectations, and the unemployment rate unexpectedly rose, which offset each other. The market bet that the interest rate would remain unchanged in June, and the interest rate hike was expected to rise in July. The swap contract linked to the Fed meeting completely digested the expectation of raising interest rates by 25 basis points in July. In May, wage growth slowed down, with a month-on-month increase of 0.3%, in line with expectations, with a year-on-year increase of 4.3%, which was lower than the expected value of 4.4%.

Microsoft Office 365 AI Assistant Pricing Exposure: Pay 40% more than the regular version.

More than 600 of Microsoft’s largest customers, including Bank of America, Wal-Mart, Ford and Accenture, are expected to try the artificial intelligence function in Microsoft Office 365, and at least 100 of them have paid an additional annual fee of up to $100,000 for 1,000 subscription accounts. (On the basis of the original annual fee of Office 365, each account will spend $100 more). It is said that the number of participants in the trial program has exceeded Microsoft’s expectations.

After AI overheated, the Rothschild family cashed in to "reduce" NVIDIA.

Edmond de Rothschild, the asset management agency of the Rothschild family, has been over-allocated to NVIDIA for a long time. The CIO of the company said that the position is much less now. In view of the high valuation of AI, it is increasingly uncertain whether to increase the position of AI technology stocks. If the valuation continues to grow, it will be more cautious. According to a recent survey, most analysts expect NVIDIA to have room for growth, and its average target price is 9% higher than Thursday’s close.

Apple will hold the developer conference in 2023, and more and more MR "revelations" are coming out.

According to the media, Apple will provide some developers and participants with the opportunity to try the new head display. In addition to the on-site trial, there are also many rumors about the appearance, capacity, mass production and time to market of the head display. Morgan Stanley said that Apple’s first head display will enter mass production in October and go on sale in December.

Apple may release a 15-inch MacBook Air with M2, M2 Pro or M3 chips at WWDC in 2023, with an estimated starting price of $1,749. However, analysts believe that the 15-inch MacBook Air is not very attractive to consumers, because the performance has not improved significantly and the price is not attractive.

[financial calendar]