The peak of debt repayment under the "three red lines" is coming, and the average sales price of housing enterprises is generally lower.

By the end of the year, real estate enterprises are facing the dual pressures of reducing liabilities and offsetting performance. In the fourth quarter, under the guidance of policies, the impact of leverage reduction of housing enterprises continued to deepen, and the financing side continued to be limited. At the same time, a large number of housing enterprises pushed the supply and demand relationship to reverse, and the average sales price fell overall. According to Ping An Securities Research Report, from the monthly performance, the Shenwan real estate sector fell by 4.4% in October, underperforming the Shanghai and Shenzhen 300(2.35%). As of November 19th, the PE(TTM) of the real estate sector was 9.29 times, which was 15.1 times lower than that of the Shanghai and Shenzhen 300, and its valuation was in the 18% position in recent five years.

According to industry analysis, under the expectation of industry financing tightening, the annual sales target pressure will be superimposed, and the housing enterprises will follow up or increase the push and sales payment, and the supply will continue to be heavy at the end of the year.

The peak of debt repayment is coming under the "three red lines"

According to the monitoring data of Ping An Securities, in October, domestic bonds, overseas bonds and collective trusts of real estate enterprises issued RMB 26.1 billion, US$ 5.2 billion and RMB 45.4 billion respectively, with a decrease of 35.7%, an increase of 29.2% and a decrease of 28.4% respectively. Considering the expected maturity of domestic debt of 83.3 billion yuan and overseas debt of 8.7 billion dollars from November to December, the maturity scale is relatively high. It is expected that the financing attitude of housing enterprises’ bonds will remain positive, but the scale may be restricted by the tightening of supervision.

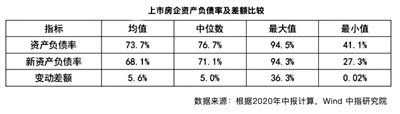

On August 20th, the Ministry of Housing and Urban-Rural Development and the Central Bank held a forum for key housing enterprises, and put forward new regulations for financing supervision of real estate enterprises, including the asset-liability ratio after excluding advance payments (hereinafter referred to as "new asset-liability ratio") should not be greater than 70%. Among the three standards, if an enterprise reaches any one, it is regarded as "stepping on the line".

In terms of horizontal comparison, China Index Academy pointed out that among the 28 industry classifications of Shenwan, the asset-liability ratio of the real estate industry is 79%, ranking third in the industry. According to the new asset-liability ratio standard, 55% of listed real estate enterprises have a debt ratio of over 70%. This means that there is only one of the "three red lines", and more than half of the "stepping on the line" enterprises, and the pressure on these enterprises to reduce debt will continue to exist during the year.

According to the interim results of listed real estate companies and the new regulation of "three red lines", the Central Reference Institute pointed out that 121 of the 172 listed real estate enterprises monitored had different degrees of "stepping on the line" and 33 enterprises "stepping on the middle". Among them, the new asset-liability ratio is the highest.

Zhongtai Securities analyzed that after the introduction of the new regulation of "three red lines", the overall expectation of the real estate industry stabilized, and the previous business logic of adding leverage to hoard a lot of land and earn a rapid rise in house prices was completely broken, and the financial attribute of the real estate industry weakened while the manufacturing attribute was strengthened. From the perspective of industry competition pattern, the core competitive advantage of real estate development enterprises will transition from land acquisition ability to financing ability and management and control ability. High-quality leading housing enterprises in the industry can continue to outperform the industry and achieve the improvement of concentration.

Judging from the overall performance, china galaxy believes that the performance of the real estate industry in the third quarter has improved, and the leverage reduction has achieved initial results. By the end of the third quarter, the industry’s advance receipts were 3,537.196 billion yuan, an increase of 8.62% year-on-year; The net debt ratio of the industry was 136.20%, a year-on-year change of -5.06%. Under the financing supervision of "three red lines", housing enterprises began to actively reduce the leverage level in the third quarter. The agency expects that the leverage ratio of the industry will usher in a greater decline at the end of the year.

The annual performance target sprints into the countdown.

The fourth quarter is often the sprint stage for real estate enterprises to complete their annual performance targets. According to a recent report released by China Commercial Industry Research Institute, in October, listed real estate enterprises seized the sales window period and actively pushed the goods to go. Among them, leading real estate enterprises have achieved remarkable results, such as Poly Real Estate, Greentown China, gemdale, China Merchants Shekou, China Jinmao and other real estate enterprises, whose monthly performance scale increased significantly year-on-year. From January to October, the sales of Evergrande, Vanke and Country Garden all exceeded 500 billion yuan, and the cumulative sales of Sunac China and Poly Real Estate exceeded 400 billion yuan respectively.

From the perspective of volume and price structure, according to statistics from RealData, the "price for volume" of housing enterprises was obvious in October. Among them, 20 TOP50 housing enterprises chose "price for quantity", an increase of nine compared with September. At the same time, the average sales price of 14 real estate enterprises fell but failed to achieve the expected sales effect, showing the result of "both quantity and price falling".

According to the analysis of shells, from the perspective of 32 real estate enterprises that have released their October results, the average achievement rate of annual performance targets is 82%, but there are obvious differences among real estate enterprises. The target achievement rate of five housing enterprises including Evergrande and Jinmao is over 90%; The achievement rate of 17 targets is less than 80%, and the achievement rate of two targets is less than 70%. The current performance completion of individual enterprises is highly under pressure. Among TOP50 housing enterprises, it is expected that a small number of enterprises will find it difficult to achieve their annual performance targets.

According to the incomplete statistics of Ping An Securities, the frequency of housing-related policies slowed down in October, and there were 19 housing-related policies (including central and local governments) in a single month, down 50% from the previous month, of which 10 were tight, accounting for 53%. It is generally believed in the industry that "housing without speculation" will still be the main tone of property market regulation during the 14 th Five-Year Plan period. Considering that the regulation of hot cities has been tightened one after another, as the sales growth rate slows down and the property market stabilizes, the pace or synchronization of subsequent regulation tends to be stable.

According to the analysis of Kerui Real Estate Research Center, under the expectation of tightening financing in the real estate industry, with the annual sales target pressure superimposed, housing enterprises are expected to increase the push and sales repayment in the future, and the continuous heavy supply will provide some support for the transaction. However, with the emergence of the regulation effect of hot cities, the pressure of market deregulation will gradually become prominent.