Pu E said | Comprehensive multidimensional local government data helps the selection of high-quality urban investment bonds

1. The city investment government shares weal and woe.

Urban investment bond investment has always been popular among bank asset management departments because of its dual attributes of interest rate bond and credit bond. However, under the background of the introduction of new regulations on asset management, the tightening of local debt management and the deleveraging of the financial industry, with the frequent occurrence of overdue negative news by urban investment enterprises, the market pays more and more attention to urban investment enterprises in various regions.

Affected by the epidemic, the global economy is generally slowing down at this stage, and China’s economic development is facing the current situation of weak external demand and great internal economic growth pressure, and the countercyclical adjustment of various macro policies is expected to increase. At present, the regulatory policy is relatively loose, investment institutions generally face a serious asset shortage, and the primary market of urban investment bonds shows a trend of both supply and demand. However, it is worth noting that at present, the two-level differentiation of urban investment companies is obvious, and due to the limitation of business content, the debt ratio is high, and some urban investment companies have great debt repayment pressure and investment risks. Therefore, how to select regional high-quality urban investment bonds is still the focus of asset management institutions.

There are more than 2,000 urban investment enterprises in China, and Jiangsu Province has the largest number of urban investment enterprises by province. According to the statistics of Puyi standard data, as of December 31, 2019, there are 675 urban investment enterprises in Jiangsu Province that have issued urban investment bonds or trust products. In addition, the number of urban investment enterprises in Zhejiang Province, Sichuan Province and other provinces also exceeds 200. According to the statistics of Puyi standard data, there are 360 urban investment enterprises that have issued urban investment bonds or trust products in Zhejiang Province, and 252 urban investment enterprises that have issued urban investment bonds or trust products in Sichuan Province.

Urban investment bonds mainly undertake the functions of supporting urban infrastructure investment and construction, and urban investment enterprises undertake some business of local governments. The quality of urban investment bonds is closely related to the economic level, financial level and debt level of local governments. The following will take Sichuan Province as an example to analyze the local government indicators.

▍2. Sichuan’s economic development has achieved remarkable results and its debt scale is controllable.

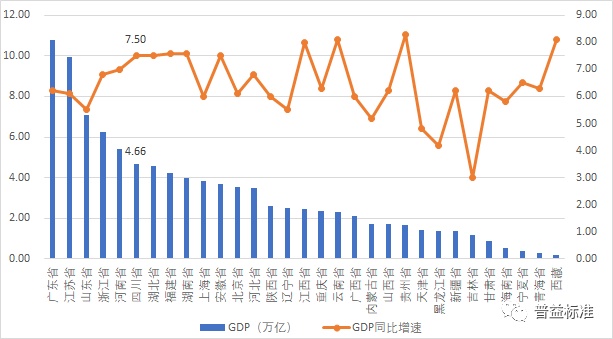

According to public data, Sichuan’s GDP in 2019 was GDP4.66 trillion yuan, ranking sixth in the country, with a year-on-year GDP growth rate of 7.5%, ranking the upper reaches of the country, indicating that the economic level of Sichuan Province is very competitive in the whole country.

Figure 1: Economic indicators of provinces in China in 2019

Source: Puyi Standard

In terms of industrial structure, the tertiary industry accounted for 52.44%, the secondary industry accounted for 37.25% and the primary industry accounted for 10.3% of the GDP of Sichuan Province in 2019. It can be seen that the province’s economy is mainly supported by the tertiary industry, and the secondary industry is assisted. It can be seen that the industrial structure of Sichuan Province is developing healthily.

In terms of fiscal revenue and expenditure, since the fiscal data in 2019 has not been published, the fiscal data in 2018 is used for analysis. In 2018, the general public budget revenue of Sichuan Province was 391.09 billion yuan, which was in the forefront of the country. At the same time, the self-sufficiency rate of the province’s general public budget is 40.24%, which is the middle reaches of the country, and the growth rate of the general public budget revenue is 9.3%, which is relatively fast. In 2018, the total fiscal revenue of Sichuan Province was only 780.101 billion yuan, with a year-on-year growth rate of 24%, of which general public budget revenue only accounted for about 50%, and government fund revenue reached 382.191 billion yuan. The sustainability of government fund revenue was weak, showing the stability deviation of fiscal revenue in Sichuan Province.

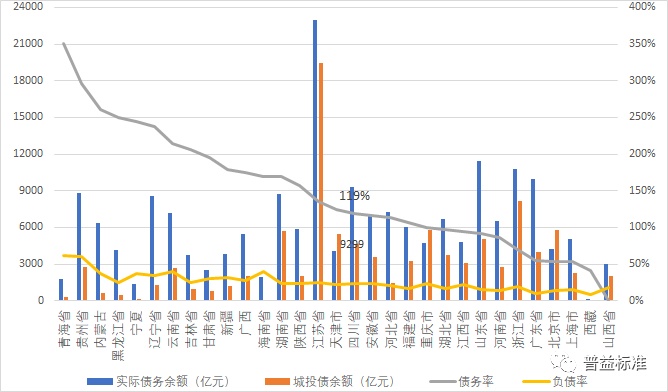

In addition to the financial level of local governments, the debt level of local governments is also closely related to the investment risk of urban investment bonds. In 2018, the balance of local government debt in Sichuan Province was 929.9 billion yuan, and the debt scale was the fifth highest in the country. At the end of 2018, the balance of urban investment debt in Sichuan Province was 462.818 billion yuan, accounting for about 50% of the government debt balance. As far as the actual debt burden level is concerned, in 2018, the province’s debt ratio was only 22.86%, and the debt ratio was 119.2%, which was lower than the national average debt ratio of 152%. Therefore, although the debt scale of Sichuan is relatively high, the overall debt level is controllable and the debt pressure is lower than the national average.

Figure 2: National Local Government Debt Indicators in 2018

Source: Puyi Standard

▍3. Rank of prefecture-level cities: Chengdu ranks first in the province in terms of evaluation of various indicators.

After analyzing the economic, financial and debt situation of Sichuan Province, it further analyzes the hierarchical levels of cities, districts and counties under the jurisdiction of Sichuan Province.

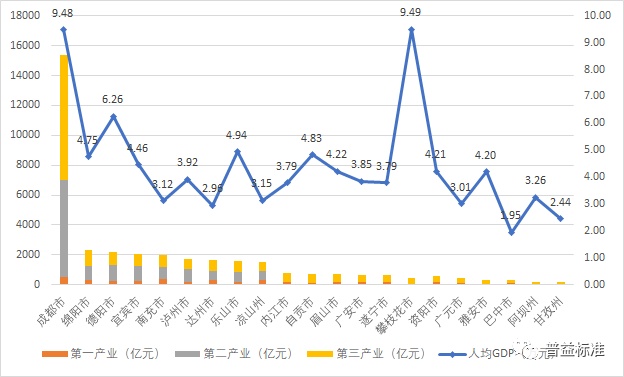

Figure 3: Economic indicators of cities in Sichuan Province in 2018

Source: Puyi Standard

The data shows that Chengdu, as a sub-provincial city in Sichuan Province, has a GDP of 1.53 trillion in 2018, contributing 36.6% to the province’s GDP, and the economic volume of the other 20 prefecture-level cities and autonomous prefectures is far from it. In terms of per capita GDP, Panzhihua surpassed Chengdu to rank first in the province, with 94,900 yuan, and Chengdu’s per capita GDP was 94,800 yuan. The per capita GDP of other prefecture-level cities is less than 65 thousand yuan.

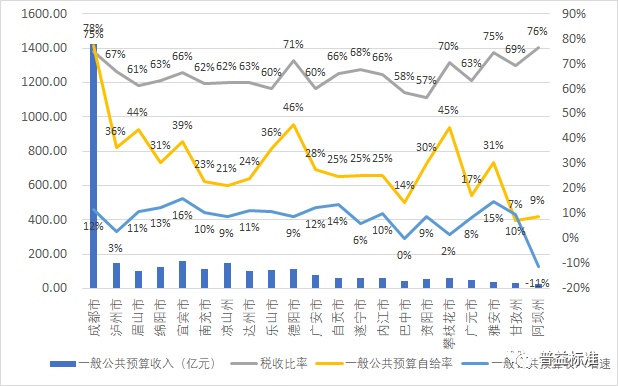

Figure 4: Financial Indicators of Cities in Sichuan Province in 2018

Source: Puyi Standard

In terms of fiscal revenue and expenditure, Chengdu’s general public budget revenue scale far exceeds that of other prefecture-level cities, about 142.416 billion yuan, with a total fiscal revenue of 283.453 billion yuan. In terms of general public budget revenue and expenditure, Chengdu has the highest financial self-sufficiency rate, reaching 78%. Judging from the growth rate of fiscal revenue, the growth rate of general public budget revenue in Yibin, Ya ‘an and Zigong is relatively high, ranging from 14% to 16%, and the growth rate of general public budget revenue in Chengdu ranks sixth in the province, with 12%.

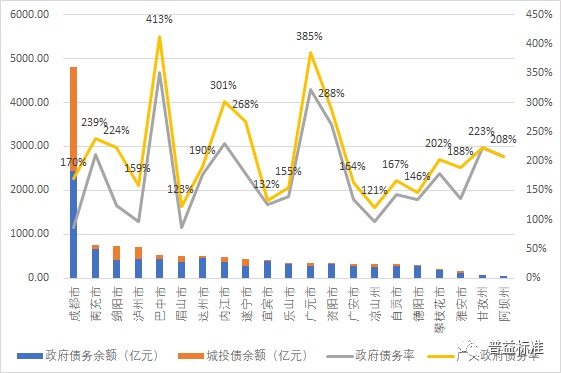

Figure 5: Debt indicators of cities in Sichuan Province in 2018

Source: Puyi Standard

At the end of 2018, the local government debt balance in Chengdu was the highest in the province, with 245 billion yuan, and the debt balance of other prefecture-level cities was less than 100 billion. From the perspective of generalized debt structure, the debt balance of urban investment enterprises in Chengdu, Mianyang, Luzhou and Suining accounts for a relatively large proportion, accounting for 39%~49% of generalized debt. From the perspective of generalized debt burden, the generalized government debt ratios of Bazhong, Guangyuan, Neijiang, Ziyang and Suining are the top five prefecture-level cities in the province, among which the generalized debt ratio of Bazhong City is as high as 413%, and although the generalized debt scale of Ganzi and Aba Prefecture is not large, the generalized debt ratios of the two States are above 200%, which shows that there is also a certain degree of debt burden. In contrast, Leshan, Deyang, Yibin, Meishan and Liangshan Prefecture are the five prefecture-level cities with the lightest debt burden in the province, while Chengdu’s generalized debt ratio is 170%, which is relatively controllable. On the whole, there are some differences in the generalized debt burden among prefecture-level cities in Sichuan Province. Chengdu, Yibin, Luzhou, Deyang and Liangshan Prefecture are supported by related industries, and their debts are more controllable.

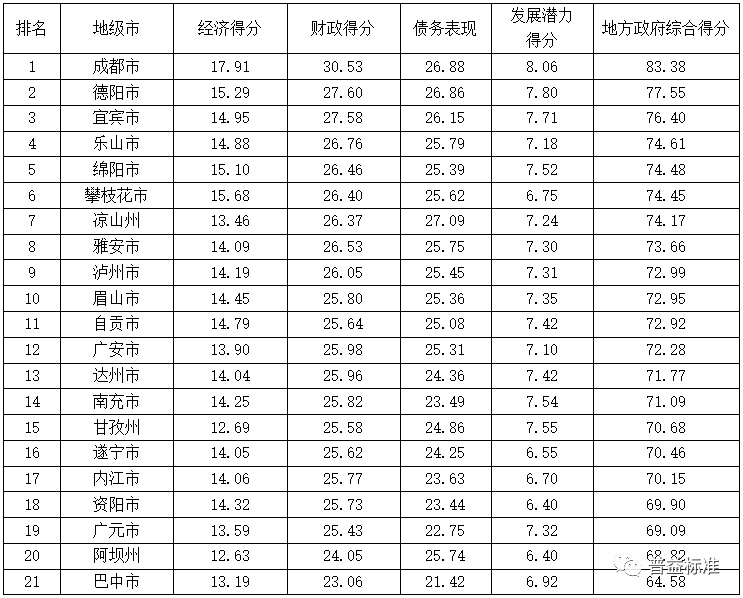

According to the financial, economic, debt, development potential and other index data of local governments, Puyi Standard further constructs an evaluation model of urban investment and debt to make a multi-dimensional comprehensive evaluation of local governments. The latest evaluation results of Puyi Standard on prefecture-level cities in Sichuan Province are as follows:

Table 1: Evaluation Results of General Benefits of Prefecture-level Cities in Sichuan Province

(2020-04-30)

Source: Puyi Standard

▍4. Rank of districts and counties: The counties under the jurisdiction of Chengdu are far ahead.

Furthermore, the analysis of the data of local governments in Sichuan province shows that the high-tech zone is still a non-statutory administrative region, so it is not included in the analysis of the county governments.

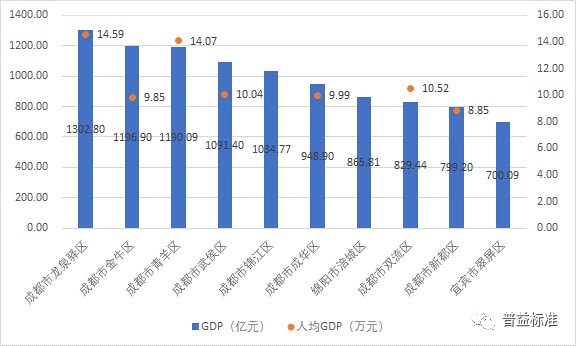

According to the public data in 2018, among the county-level governments (including county-level cities) under the jurisdiction of Sichuan Province, Longquanyi District has the highest GDP and per capita GDP, with a total GDP of 130.28 billion yuan and per capita GDP of 145,900 yuan/person. In terms of industrial structure, among the top ten counties in GDP, the economies of Longquanyi District, Shuangliu District, Xindu District and Cuiping District of Yibin City are more dependent on the secondary industry, especially in Longquanyi District, which accounts for 76% of GDP in 2018, and the automobile manufacturing industry has contributed a lot to industrial added value. The remaining districts and counties are dominated by the tertiary industry, such as jinniu district, Qingyang District, Wuhou District and chenghua district, with the tertiary industry accounting for more than 80%.

Figure 6: The top ten economies in Sichuan Province in 2018

Economic indicators of district and county governments

Source: Puyi Standard

Note: The per capita GDP data of Jinjiang District of Chengdu, Fucheng District of Mianyang and Cuiping District of Yibin have not been published.

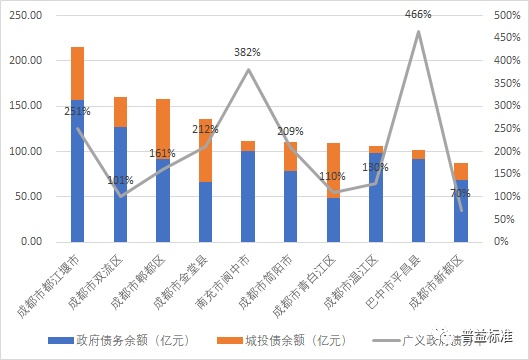

Judging from the scale of generalized debt, among the districts and counties that have announced the government debt in 2018, the balance of generalized government debt in Dujiangyan City, Chengdu is the highest in the province, about 21.6 billion yuan. The debt scale is followed by Shuangliu District, Pidu District and Jintang County in Chengdu, with a small gap of about 15 billion yuan.

Judging from the generalized debt ratio, Pingchang County in Bazhong has the highest generalized government debt ratio in the province, reaching 46.6%, followed by Langzhong City in Nanchong, with a generalized debt ratio of 38.2%. The heaviest debt burden in Chengdu is Dujiangyan, accounting for 25.1%, while the lightest debt burden is Xindu District, with a generalized debt ratio of only 70%.

From the perspective of debt structure, qingbaijiang district, Chengdu has the highest proportion of urban investment debt, accounting for 55%, and Wenjiang District, Chengdu has the lowest proportion, accounting for only 8%. As far as the balance of urban investment bonds is concerned, as of December 31, 2018, the balance of urban investment bonds in Jintang County of Chengdu was the highest, with 6.9 billion yuan, followed by Pidu District.

It can be seen that the debts of Pingchang County in Bazhong, Langzhong City in Nanchong and Dujiangyan City in Chengdu are large and heavy, and the economy lacks industrial support and financial pressure is great. The city investment enterprises under these three counties may face certain liquidity risks.

Figure 7: Top Ten Government Debts in Sichuan Province in 2018

District and county government debt indicators

Source: Puyi Standard

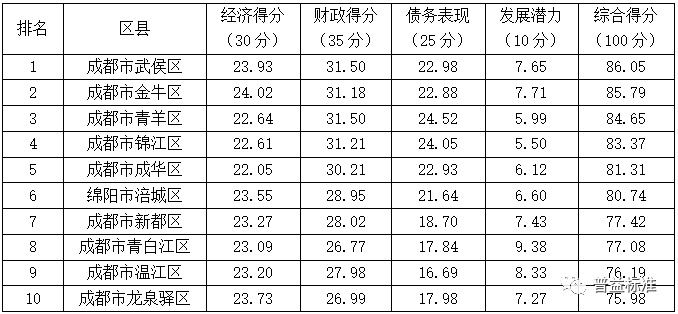

Based on the local government’s financial, economic, debt, development potential and other indicators, the latest evaluation results of various districts and counties in Sichuan Province by Puyi Standard are as follows:

Table 2: Top ten results of the evaluation of local governments’ general benefits in counties and districts of Sichuan Province

(2020-04-30)

Source: Puyi Standard

Judging from the evaluation results of prefecture-level cities and districts and counties, Chengdu is far ahead. In the comprehensive evaluation of prefecture-level cities in Sichuan Province, Chengdu ranks first with its economic strength, financial strength, debt status and development potential. In the evaluation of counties in Sichuan Province, the counties under the jurisdiction of Chengdu are also far ahead. The counties in the first echelon of Chengdu’s comprehensive strength include Wuhou District, jinniu district, Qingyang District, Jinjiang District and chenghua district, among which Wuhou District has the highest comprehensive score, with a score of 86.05. The counties in the second echelon include Xindu District, qingbaijiang district, Wenjiang District and Longquanyi District, among which Xindu District has a relatively high comprehensive ranking of 77.42.

From the specific subdivision dimension, the economic performance of Chengdu jinniu district is the best in the province, and the railway transportation and logistics trade in this area are relatively developed. In terms of finance, Qingyang District and Wuhou District performed better, followed by Jinjiang District and jinniu district, with a gap of only 0.3 points. In terms of debt, Qingyang District won the top spot and the debt situation is good. In terms of development potential, qingbaijiang district of Chengdu scored 9.38 points, surpassing the main urban area of Chengdu. It can be seen that with the gradual deepening of future industrial planning, the vitality of surrounding districts and counties may be further released.

Through the hierarchical evaluation results of prefecture-level cities and districts and counties in Sichuan Province, it can be seen that the evaluation results of prefecture-level cities and districts and counties can objectively and truly reflect the actual investment status in the province, and provide data support for the screening of investment areas of asset management institutions and the accurate positioning of urban investment platforms. Reduce the influence of subjective judgment in investment, so as to support investment decision with data.

Pue Smart Selection APP is positioned to provide investment research and information assistance for asset management practitioners. It is an APP that carries the core achievements of Puyi standard data, research, evaluation and information.

In terms of urban investment bonds, in order to obtain more comprehensive and accurate evaluation results, Puyi Standard has spent a lot of manpower and time collecting more comprehensive local government data and urban investment enterprise data, and strictly and carefully controlling the quality of relevant data.

Local government data mainly include provincial economic data (GDP, GDP growth rate, etc.), financial data (total fiscal revenue, general public budget revenue, total fiscal expenditure, general public budget expenditure, etc.) and debt data (actual debt limit, general debt limit, special debt limit, actual debt balance, general debt balance, special debt balance, etc.).

In order to form a hierarchical and more three-dimensional evaluation system, the Puyi standard has carefully evaluated the city investment enterprises and debts. The data indicators of urban investment enterprises mainly include: basic information of urban investment enterprises, industry rating information, enterprise financing situation and financial data. Debt data mainly include: bond balance, bond issue date, maturity date, coupon rate, remaining term, etc.

This article first appeared on WeChat WeChat official account: Puyi Standard. The content of the article belongs to the author’s personal opinion and does not represent Hexun.com’s position. Investors should operate accordingly, at their own risk.