Boiling of domestic electric vehicles 2023: Towards a more cruel poker table

A few months ago, Wang Huiwen, the co-founder of Meituan, sent a feeling at an instant meeting:"The development curve of science and technology includes not only the Internet and smart phones, but also electric vehicles. The first electric vehicle was produced in the 19th century, and gasoline vehicles dominated the world for more than 100 years."Some people in the comment area said that there was a lab fire that destroyed Ford and Edison’s tram efforts, and then history turned a corner, and electric vehicles were completely replaced by fuel vehicles.

However, the historical change will not be so arbitrary. In the process of actual development, the development of urban roads, the change of oil supply, the promotion of policies and other factors, whether to use electricity or oil, there are several ups and downs in the middle.

For example, during the oil crisis in the 1970s, manufacturers such as General Motors and Ford developed electric vehicles. More than a decade later, the economic crisis broke out. In order to cope with the impact of imported cars such as Toyota Honda, the US government launched a zero-emission vehicle program. However, whether it is the early GM EV-1 or Toyota’s RAV4 EV, it is always difficult for electric vehicle manufacturers to make a profit, whether it is to restrict leasing or open sales.

In the impression of many people, it was not until Tesla loaded with lithium batteries appeared that it was a true tram revolution. But before that, the lead-acid battery made the first electric car more than ten years earlier than the gasoline car. By the end of the 19th century, the electric car and the fuel car were even neck and neck. Therefore, from the perspective of the car itself, battery capacity and high cost are the most important problems that limit the development of electric vehicles.

In 2010, Tesla went public on NASDAQ with a financing amount of $226 million.

In the following week, Tesla’s share price soared by 40%, and its market value was as high as 10 billion US dollars, even surpassing the old car companies Fiat and Mitsubishi. Put the clock back to 2014. In that year, Musk published the famous article "All our patent is believing to you" in Tesla official website. He said."Yesterday, there was a patent wall in the lobby of our headquarters, but now the situation has changed. In order to promote the development of electric vehicle technology, we knocked down this wall."

A month later, LeTV was founded, and then Weilai, Tucki and Ideals emerged as new forces. At the beginning of its establishment, Li Bin said that Weilai would rank among the top five in the world in 2030 and become a global intelligent electric vehicle company; Li Xiang threatened in his internal letter that his goal is to reach the first place in the domestic market share in 2025 and rank among the top three in the world; Compared with the top two, He Xiaopeng is more direct, and its product strategy orientation is almost benchmarking Tesla.

According to the report released by China electric car committee of 100 earlier, the future car will reproduce the intelligent evolution path of mobile phones. According to the development law of the industry, for example, Nokia survived for nearly 50 years before the mobile phone was fully intelligent, but once Apple appeared, it took almost five years to subvert and disintegrate the old pattern.

The implication is that this change in the underlying logic brought about by technological upgrading will cause extremely tragic disputes in the industrial chain.

Therefore, in the two years from 2020 to 2021, there are fewer and fewer secrets of new energy vehicles, not only Wei Xiaoli. On the track where new and old players gather, from product performance and intelligent configuration to various scenes created by car companies, there is an all-round killing around the car. Faced with the question of falling behind, Weimar founder Freeman Shen gave the response at that time."New energy is a long-term track, just like playing football. Now we haven’t finished the first 15 minutes of the first half, and we don’t know who wins or loses."

In September last year, the penetration rate of new energy vehicles in China exceeded 30%, and the overall growth rate of the market declined. At the same time, various car companies still set quite radical goals. Nowadays, they are standing at a new starting line again. While the penetration rate of new energy vehicles has increased, there have also been more players. The recession, price increase, price reduction, sluggish consumption and organizational turmoil have made the already hot-water industry press the acceleration button.

On this issue, He Xiaopeng once admitted that after experiencing Tesla’s electric car, his intuition told him that the car would have new changes."Everyone has been hit hard by smart phones, and everyone thinks that Apple and Nokia will repeat themselves in the automotive field."

Prior to that, Tesla went public in 2010, BMW began to develop pure electric vehicles, and China also released a promotion plan for new energy vehicles. Some analysts believe that in the short term, it is difficult for China car factory to catch up with foreign countries in internal combustion engine technology. With the continuous improvement of battery, motor and controller technology, people with a little sense of business know that if they want to rise, they have to rely on new energy vehicles.

In 2017, He Xiaopeng parachuted to Xpeng Motors as the chairman and re-planned the G3 Beta version of the company’s first production car; At the same time, Weilai’s first car, the ES8, appeared at the Shanghai Auto Show. Li Bin stood on the stage, and all the market confidence in this 7-seat pure electric SUV was integrated into his own language and body expression.

According to the law of making cars in the industry, a car that has already appeared must be completely replaced, and it will take at least five years from research and development, experiment and listing. Weilai automobile has been used for 3 years from scratch; One year after He Xiaopeng joined, G3, the benchmark Tesla Model 3, also entered the market smoothly, with the subsidized price of 135,800-165,800 yuan, which is also the best-selling model in Tucki.

New power players grab the results faster, but the sound of the tide falls to both sides.

In Tucki’s shareholder list, besides Ali and IDG, Xiaomi, Chunhua Capital and Foxconn are also listed. Behind Weilai are investment giants such as JD.COM, Temasek and Sequoia. The ideal investors include Wang Xing’s Dragon Ball, ByteDance and Source Code. The track of new energy vehicles is hot, and all capitals want to share a piece of it.

But many people remain skeptical.

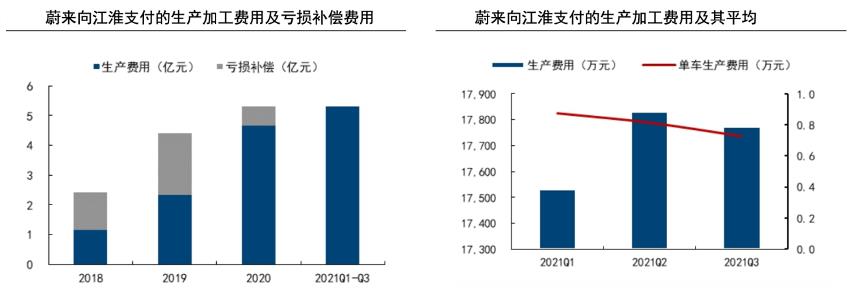

Although the Internet is very popular, as a commodity car, it cannot easily change its special technical attributes. Countries have strict regulations on R&D and production of engines, transmissions, front and rear axles and frames. For example, ES8 is produced by Jianghuai Automobile, but whether it is pure electric or mid-to high-end car market, Jianghuai itself is still tossing.

In fact, Wei Xiaoli started as an OEM. They found Jianghuai, Haima and Lifan respectively. None of them are mainstream car companies and have no value of brand endorsement. However, the period for Weilai and Tucki to assemble a complete vehicle is much shorter than ideal. From the establishment of a branch in Changzhou in 2016 to the acquisition of Lifan two years later, Li ONE, the ideal first model, won’t be officially mass-produced until the end of 2018.

According to soochow securities’s research, in terms of chips, Wei Xiaoli adopts NVIDIA solution; The millimeter wave radar, brake and other components of the sensor are mainly Bosch products; The battery cooperates with Contemporary Amperex Technology Co., Limited, and Qualcomm chip is used in the cockpit. In the process of the birth of a complete vehicle, Wei Xiaoli plays the role of design, research and development, purchasing key components, and then looking for a factory for assembly and production.

From the point of view of profit, car-making is actually a very thin industry. Compared with BYD’s complete vehicle manufacturing industry chain, Wei Xiaoli’s stacking car-making model has low degree of autonomy of parts and components and no advantage in cost; On the other hand, since they are OEM, it means that they do not have absolute right to speak in the downstream supply chain.

According to Wan Haoji, partner of Jingwei China, I feel that Tucki made a "smart phone that can be opened", which also revealed the helplessness at that time:The basic manufacturing level is unreliable, so immature functions such as mobile KTV and remote control are used as marketing gimmicks, and even the joke that He Xiaopeng’s "automobile operation is the core and manufacturing is not important" was born.

At the same time, since Model 3 announced mass production, it began to fall into a "capacity crisis". At that time, Tesla even spent $100 million a week to promote capacity climbing. The former CEO of General Motors even asserted that Tesla was about to close down. Only after the first quarter, the latter lost $700 million.

Although Tesla later relied on strong funds to survive the mass production problem. But other players still can’t escape the shadow of capital shortage. Even Rivian, which Amazon has high hopes for, can only achieve scale by cheaper production. It will take 3-5 years for a traditional car manufacturer as strong as Volkswagen to barely match Tesla in the cost and profit of electric vehicles, not to mention the newcomers who started later.

On the second day after the release of G3, He Xiaopeng admitted in a group interview that the company can’t meet the large-scale delivery now.

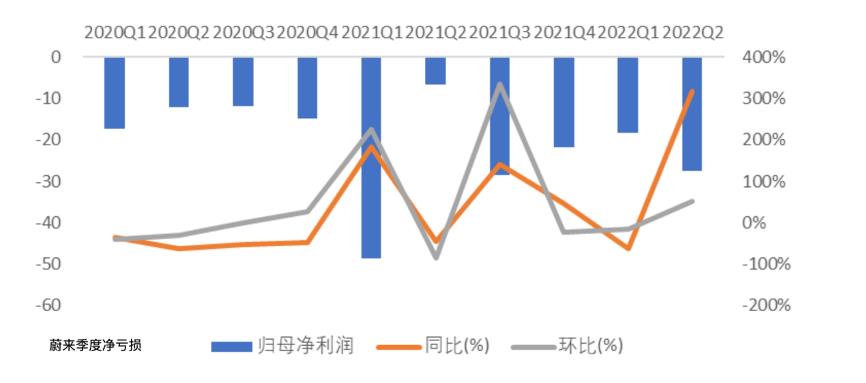

Similarly, in 2019, after experiencing ES8 spontaneous combustion, battery recall, stock price crash, massive layoffs and huge losses of tens of billions in four years, Weilai’s annual net loss soared to 11.3 billion yuan. Although its sales volume reached a record high in the fourth quarter, its gross profit margin was still negative -8.9%, and its cash balance was only about 1 billion yuan. Without money, Li Bin became the "worst entrepreneur of the year" that year.

The relatively stable ideal spent 650 million yuan to buy the equity of Lifan Automobile, but was burdened by the debt problems left over, and was listed as the executor several times in succession. The main "extended program" was not optimistic in the industry, and the performance promotion failed to turn up much storm. Coupled with the increase in the subsidy threshold, the already poor family is even worse.

In front of these new forces, it is actually a very long-term problem.

When "Later Auto" asked about the storm, Li Bin used the word "perfect" to describe it. He said:All the expected and unexpected things have happened, and nothing has not happened. Competition from external industries, changes in the capital market, internal batteries, and early production capacity problems of ES8 were all exposed at the same time.

However, after the capital chain crisis in 2019, it was followed by the impact of the epidemic on the supply chain, the lack of upstream expansion, the lack of core in the global automobile industry chain, and the difficulty in alleviating the production capacity problem; The cost of raw materials for lithium carbonate has risen. Some media revealed that the average cost of a car will increase by 30,000 to 40,000 RMB. If it is reflected in the price level, it must increase by 40,000 to 50,000 RMB to reach the gross profit level of the same period last year.

However, the problem is that the domestic consumer market is even more reluctant to accept price increases, although it has a bad feeling about price reduction.

Li Bin said that a car can’t be produced without a part.

In the interlocking automobile industry, as mentioned earlier, most assembly enterprises rely on stacking materials, with very low degree of freedom. They only master the design and production of core accessories such as engines and gearboxes, and at most add the final automobile assembly link. However, a black box scheme like chassis, even if it is full of high-end hardware, may not be able to assemble a good car that can match the luxury configuration list.

Previously, Tesla independently developed the software and hardware of intelligent driving and cockpit, which enabled the rapid iteration of OTA of the whole vehicle, and the self-developed autopilot chip also landed in mass production, with a computing power of 144TOPS, nearly five times that of Xavier of NVIDIA, which also made Tesla lead the industry again in technology and cost control.

Later, a new car-making technology executive said that,"Tesla has already run out, so just copy your homework."

In 2020, Weilai came back to life, and its share price soared from approaching the red line of delisting to around $28, making it the second largest car company in China after BYD. Wei Xiaoli followed Tesla’s example and launched independent research and development of cockpit and intelligent driving. Among them, Tucki was the first to build a Chinese and foreign R&D team. Ideally, after the IPO, he began to recruit talents and develop intelligent driving. In addition to the perception of intelligent driving, Weilai has also developed its own planning, control algorithm and battery.

As for the chip, Li Bin wants to walk on two legs for this hardware that needs a lot of resources and capital investment. First, he adopts the supplier’s scheme to realize mass production, but also builds his own ability. At the same time, Weilai adopts the chip scheme of Qualcomm. Ideally, they will not develop their own chips at the stage of 1-10. Like Tucki, both companies are locked in Orin in NVIDIA, with a computing power of 200TOPS and a power consumption of 45W.

After the initial attempt to cooperate with Daimler, Tesla established a super factory all over the world. Since the factory was built in Shanghai, the stock price has also risen, and the market likes Tesla’s gameplay. However, it is boosting the market’s confidence in electric vehicles. At the same time, it also widens the gap with the new domestic force Wei Xiaoli.

In 2021, Tesla China sold 484,100 new cars, including 320,000 in China. As for Wei Xiaoli, the annual delivery data were 91,429, 98,155 and 90,491 respectively. By the time the cooperation agreement between Weilai and Tucki and the foundry expires, Tucki has also turned to self-construction.

At this time, there is another problem, just like Wei Xiaoli does not do 4s stores directly. The former has to establish an integrated system before it can have absolute right to speak, but most direct stores are opened in shopping malls, and the gap in sales model also raises the entry threshold:The premise is to have a strong market share and strong bargaining power.

The same is true when it is put into a factory.

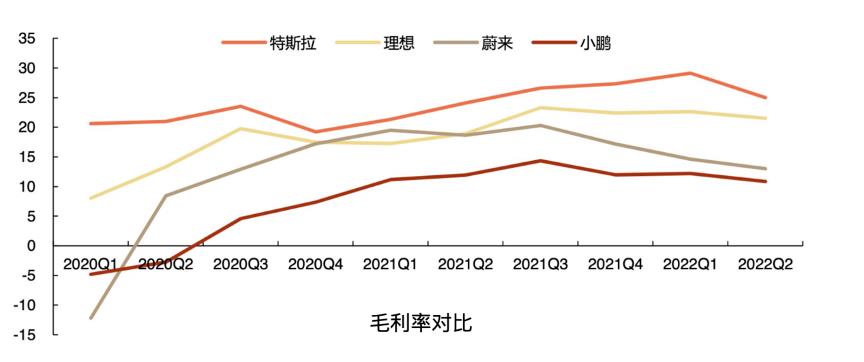

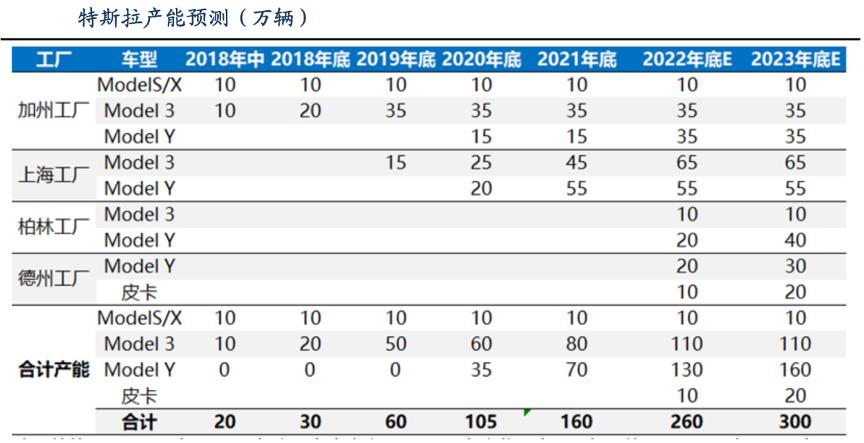

An electric car company with a few models, coupled with the overall poor market performance, is not easy to sell, and has invested a lot of money in marketing education and price war. At this time, it is easy to make a big factory at the same time, which is not worth the candle.Tesla can achieve high gross profit, mainly due to the small number of models, huge sales volume and low cost. From 2017 to 2021, Tesla’s global vehicle sales grew at a compound annual growth rate of 56.54%, which tripled in five years. Its advantages lie in core technology and brand power.

The universal rate of parts of Tesla’s full range of models is as high as 70%. For example, the motors used in Model Slaid and Model 3 are the same. The former is only optimized: the protective sleeve of carbon brazing dimension is added to the motor rotor, and the content of precious metals and the complexity of manufacturing process are reduced on the battery. In addition, the weak dependence on chips not only controls the right to speak in the chip value chain, but also indirectly promotes the right to negotiate for the foundry to master the production capacity.

What does the market’s imagination space for new energy vehicles come from?

It is difficult to answer this question because of long-term losses. If the market share keeps rising while losing money, that’s fine. If you lose money while investing, the market share will drop, and the result can be imagined."We can build a few factories on a small scale and try to get some things in our hands. This is what everyone should do."Some insiders said,"But this is not completely autonomous and controllable."

Tucki, which is on a par with Tesla in terms of technology, insists on the route of full-stack self-research and low-cost mass production, but this has not made it and Tesla step into the same happy river.

In the early days, limited by the policy, OEM cooperation was carried out, and factories were built in Zhaoqing and Wuhan after reaching the threshold of building factories. Tucki’s plan is similar to Tesla’s strategy of rapidly occupying the market with two mid-range models, Model 3 and Model Y.

Li Xueling, an investor in Xpeng Motors, once said that in China, car manufacturers should pay more attention to the sinking users in Pinduoduo, "He Who Wins a Dior Si Wins the World". Therefore, the overall price of Xpeng Motors is lower than the other three. Compared with the price of ES8 in Li one and Weilai, which started at 300,000 in the same period, the average landing price of G3 is less than 150,000, which attracts some young people and a large number of car owners who are driven by subsidies from new energy policies.

However, the performance of G3 in the market is not perfect. Tucki also recalled a batch of products with more than 10,000 inverters, and the failure rate reached 70%. Although the price of the subsequent coupe series P7 and P5 has reached more than 200,000, the delivery performance is mediocre, and the price is still far from the high-end of friends.

In fact, Tucki’s low-line positioning has not affected the high cost of R&D, sales network and after-sales. In the first quarter of 2018-2022, the accumulated R&D expenditure of Tucki reached 10.2 billion yuan, accounting for 27.8% of the accumulated revenue, and the R&D expenditure rate was ahead of the domestic new forces for a long time.The consequence of "burning money for R&D" at any cost is that Xpeng Motors has achieved good patent results, a leading R&D expense rate and a gross profit margin that lags behind other players.

On the other hand, Tucki captured a number of car owners who needed the driver assistance function because of the long-term failure to update the user’s FSD service in Tesla China. However, in the current demand, such an intelligent system, coupled with more restrictions on domestic terms of use, could not be the first choice for users. Weilai, with a slightly lower delivery volume in the same period, was several times higher than Tucki in revenue.

Of course, buying a car depends on the brand. The premium brought by product positioning and added value of brand power has become the most significant difference between the automobile industry and the Internet industry. The key is such an impact, and the timeliness is particularly long.

Wei Lai’s path is different from Tucki’s.

"Many people think they can make products, but I think there are very few people in the automobile industry who can make products." Product problems need to be solved concretely, and we can’t get angry and worry. In Li Xiang’s view, Wei Lai is a conservative who doesn’t expect too much. Li Bin is his old rival and one of his "few".

All along, people’s deepest impression on Weilai is not its self-research and technology, but its service of fishing under the sea.

For example, the rights you can enjoy as long as you buy a car, such as off-site power supply, lifetime warranty, road rescue and car networking services, are applicable to the ES8 and ES6 models that Weilai is selling. Weilai’s road service team directly operates the "Weilai Driving Service", and the staff can be called the butler level. It not only provides users with driving and picking up, but also can pick up and drop off children, accompany the elderly to see a doctor, do homework with children, and other intelligent system maintenance services that car companies basically do not need to invest hard.

If it comes to battery life, Tucki emphasizes charging stations in addition to charging piles; Although Tesla has considered the technology of power exchange, it has not introduced a power exchange station. On the contrary, it has continuously invested in overcharging stations and piles. Li Bin, who is watching the fire from the other side of the bank, has always claimed that Weilai’s "charging is more convenient than refueling" to give users a better driving experience, so Weilai chose "changing power station+mobile charging car" as the main charging mode.

In 2022, there were 528 new power stations in Weilai, and the cumulative number has reached 1,305 (including 346 expressway power stations). At present, Weilai users have changed power more than 15 million times. In addition to the product itself, Weilai’s service is also an important support for enterprises to gain a foothold in the high-end pure electricity market.

The whole stack of self-research, charging and replacing electricity, and serving this whole set of things is called systematic ability by Wei Lai.

With the massive investment of manpower and material resources, the ever-expanding variable is that Weilai’s investment may not necessarily be translated into product competitiveness and market returns. Li Bin is also aware of the risks, so he emphasizes to employees that "if time and money are spent, nothing will be done by 2025", and Weilai may fall into the second echelon and steal peace.

Then the question is, the service effect that the enterprise has spent so much money on, if it originally required users to buy a car for 400,000 to 500,000 yuan, is it possible that with the first-Mover advantage of car-making enterprises gradually declining, the worry-free service in the past has become a welfare that can be enjoyed as long as 200,000 to 300,000 yuan or even hundreds of thousands? The cost side continues to be under pressure, and the competitiveness of the brand may be affected. In this case, can Weilai’s service continue to maintain its value and quality?

This is a question that will not be answered for the time being.

According to insiders, the sub-brands polished by Weilai will operate independently, and the price will drop to less than 200,000, with the intention of entering the sinking market before the bonus period of new energy vehicles ends.

But at the same time, it also means that in fact, in terms of brand, Weilai has made concessions on differentiated positioning.

In 2021, Li Bin mentioned in an interview that the mobile phone industry was varied at the beginning, and then gradually converged, and cars were also in this process. He believes that by 2025, smart cars will find the ultimate product, technology will slowly converge, and Weilai will put his hopes on autonomous driving.

"Autopilot will change the appearance of the car, the structure inside the car and the shape of the digital cockpit."Li Bin said,"If you go to make a mobile phone today, it will be a bit meaningless."

But this statement didn’t last long. Last year, Li Bin changed his tune, saying that Weilai would develop a mobile phone every year like Apple. He explained to the car owners that more than 50% of Weilai users used the iPhone, which was relatively closed and didn’t open the interface, "equivalent to the opponent’s hand". He believes that car-machine interconnection is a trend. From the perspective of user privacy and experience, Weilai needs to study mobile phones and car-centric intelligent terminal devices.

Weilai’s logic of making mobile phones, the outside world is not willing to pay the bill, but what is revealed between the lines is Weilai’s increasingly anxious atmosphere of user increment.But at the beginning, Li Bin was right. Now, standing at the node of 2023, domestic electric vehicles have developed for nearly ten years, and it is indeed near the time of shuffling.

One-third of January has just passed. First, in an internal letter, Li Bin reminded everyone that the growth rate of Weilai’s delivery lags behind the overall smart electric vehicle market in China, and criticized the company’s problems: supply chain management, quality problems, accidents, user feedback and internal organizational efficiency, all of which are common problems encountered by new car-making enterprises. Later, Lei Jun gave the car-making team blood, and officially announced that Xiaomi Automobile is expected to be released within the fastest year and put on sale in 2024.

The tension spread to Tesla. In the fourth quarter of last year, Tesla delivered a total of 405,278 vehicles, but it still failed to catch up with the expectations of analysts after repeated downward adjustments. The delivery volume of 1.31 million in the whole year did not fulfill Musk’s promise of an annual growth of 50%. At the end of the year, Tesla’s share price fell by 37%. Not long ago, on the sixth day of the new energy subsidy, Tesla’s domestic models began an unprecedented price cut. Except for Model Y, Model 3 was the lowest entry price in the history of domestic Tesla.

It is worth noting that this crisis is different from the previous capacity climbing, but Tesla’s order reserve is not enough, and the supply is far greater than the demand.According to public data, Tesla’s global backlog of orders has been rapidly decreasing in recent months. Under the direct mode, there is no dealer’s ability to carry inventory, and the market demands higher products and sales. The direct reason behind this is that the sales growth rate in China market is far lower than Tesla’s production capacity.

Tesla’s price reduction has become the most direct and effective strategy to increase sales. On the other hand, the new car-making forces and the new energy brands under the traditional car companies have all announced their sales transcripts in 2022. According to the data, the sales completion rates of Wei Xiaoli’s three companies were 78.38%, 48.30% and 81.66% respectively, and most car companies still failed to meet the annual sales targets set at the beginning of last year.

Among them, last year, Tucki’s sales volume declined for five consecutive months, and after the G9, which had high hopes, lost, Tucki gradually fell behind, GAC Ai ‘an won the sales championship in 2022 with 270,000 vehicles, and Nezha, the second echelon, began to attack and overtake from the second half of the year, ranking second with the delivery volume of 152,000 vehicles sold annually. At the same time, BYD’s annual delivery volume exceeds 1.86 million vehicles, exceeding the target of 2022, and raising the sales target to 4 million vehicles this year. Although the sales volume of automobiles does not represent the absolute transcendence, it also reflects the fierce degree of market competition.

According to the official forecast of the Association, the wholesale sales volume of new energy passenger cars in China will reach 8.4 million in 2023, an increase of 30%.

With the market stimulating consumption and the withdrawal of new energy subsidy policies, in addition to the traditional luxury brand BBA, new brands such as Xiaomi, Huawei, Jidu, and Extreme Krypton have joined, many car companies have successively raised the price of their models to cope with the cost pressure.

But if the competitor reduces the price, will it follow or not?

If you don’t follow the gross profit, you will lose market share, but you will lose profits. In a word, the market is gradually becoming a red sea, and the elimination of the electric vehicle industry will only be more cruel.

In an interview in 2018, He Xiaopeng was asked about the gap with Musk. He was neither humble nor humble:Now he is better than me, and I may be better than him in the future.Two years later, facing the same question, He Xiaopeng’s answer became:I don’t think there is any gap between us. He is in his field and I am in my thinking logic.

In 2021, he said:"We didn’t know about cars at that time, and thought that maybe the war of cars would be finished in 10 to 15 years at most. Now it may be more than that. "The changes in the industry and market are beyond his expectation.

In the past, both Lei Jun and Li Xiang thought that the competition in the industry would eventually leave five companies and put themselves in it. When the same question was thrown to Tucki, he said that there were at most seven companies, and only Tesla confirmed them. Other companies were still on the way, and there might be Tucki among them.