In the first quarter, the net profit was 930 million, and LI’s continuous profit broke the "curse" of new power losses.

(Text/Liu Huiying Editor/Zhang Guangkai)

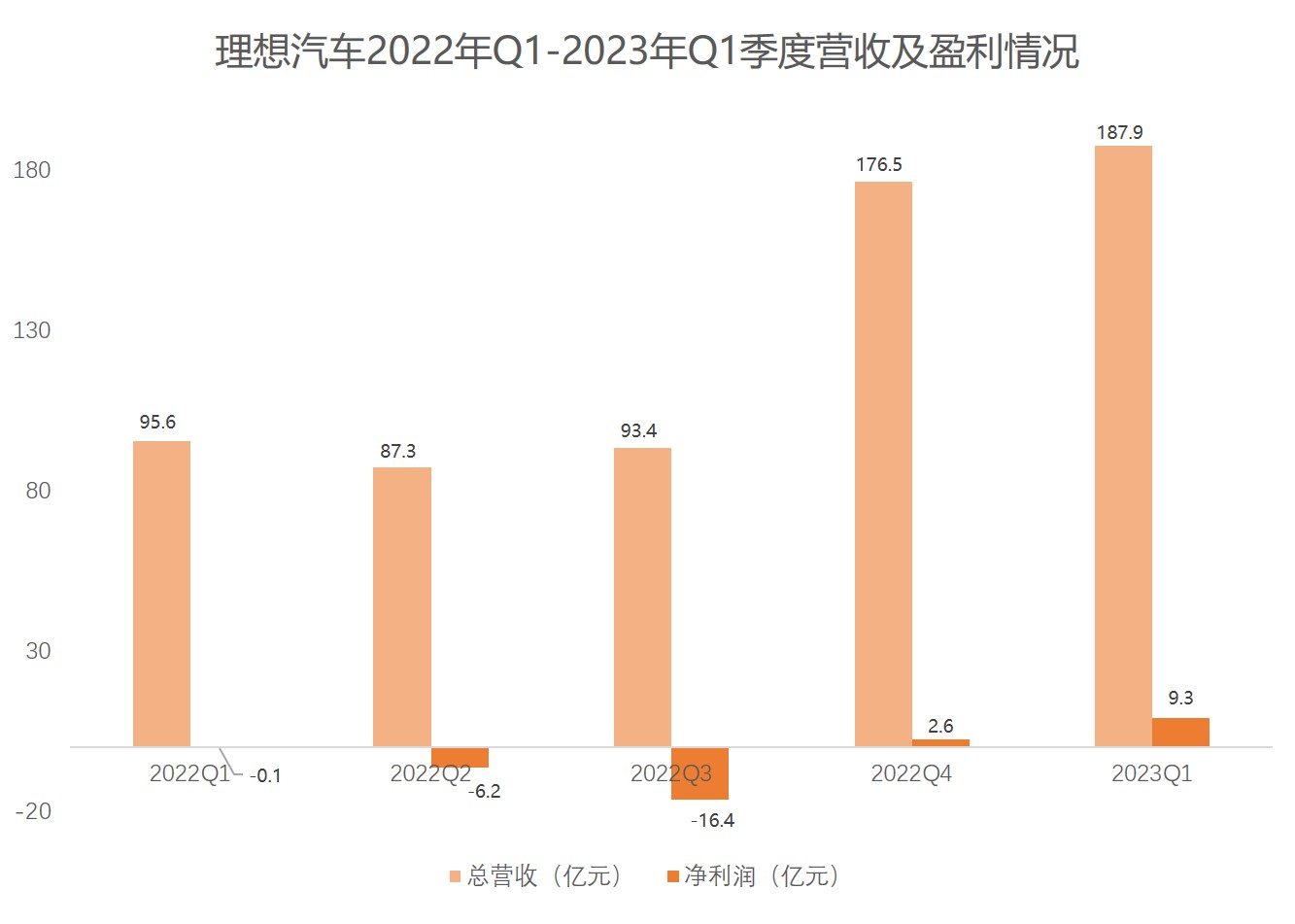

On May 10th, 2023, LI announced its financial report for the first quarter of 2023. The revenue and delivery in the first quarter reached record highs, and it became the first new force in China to make profits for two consecutive quarters.

LI achieved revenue of 18.79 billion yuan in the first quarter, up 96.5% year-on-year. In the same period, LI delivered a total of 52,584 new cars to users, up 65.8% year-on-year, and entered the top three sales of new energy brands with a market share of about 11% in China. In the first quarter, LI invested 1.85 billion yuan in R&D, up 34.8% year-on-year.

LI’s net profit of returning to her mother was 930 million yuan, which was 257.7% higher than the net profit of 260 million yuan in the fourth quarter of last year. This profit also far exceeded all previous single quarters, and achieved profit for two consecutive quarters. After deducting the equity incentive, the operating profit and net profit reached 890 million yuan and 1.41 billion yuan respectively, and the free cash flow reached 6.7 billion yuan.

In the first quarter, the gross profit margin of LI was 20.4%, but the gross profit margin of vehicles dropped to 19.8%, which was 22.4% in the first quarter of 2022 and 20.0% in the fourth quarter of 2022.

Li Tie, co-founder and CFO of LI, said that the decrease in gross profit margin of vehicles in the quarter was caused by sales in Li ONE, and the company expects to complete all sales in Li ONE in the first half of the year. In addition, the profit margin of the ideal L7 and Air models still has room to climb, but considering other potential factors, the company still maintains the goal of 20% gross profit margin for the whole year.

In terms of delivery, LI’s delivery volume continued to climb from January to April 2023. In April, the delivery volume of LI exceeded 25,000 vehicles for the first time, with a year-on-year increase of 516.3%, setting a record for delivery in a single month since its establishment, and delivered more than 20,000 vehicles for two consecutive months.

From the performance of market segments, the ideal L7 has delivered over 10,000 yuan in the first complete delivery month after listing, while the ideal L8 and the ideal L9 have maintained the leading sales of the segmented track since the delivery last year.

In terms of smart space and intelligent driving, the ideal L-series models have completed two OTA version upgrades of 4.3 and 4.4 this year, and optimized more than 100 functions and experiences.

In OTA 4.4, the new version of the car has added sentry mode, and the system will automatically detect the situation around the car and remind users according to the level of different situations, and realize that the energy consumption for the whole night is only about half of that of other models through power saving strategy; At the same time, users equipped with the ideal AD Max intelligent driving system also get LKA Plus function through the recent upgrade, which helps car owners to automatically change lanes when navigation is not turned on, reducing driving fatigue and improving traffic efficiency.

"According to the established goal, LI will promote the urban NOA function to 100 cities nationwide by the end of 2023, and the order and logic of the promotion are related to the number of local LI models," said Ma Donghui, president and chief engineer of LI, adding that because the technical framework of NOA in LI does not depend on high-precision maps, our urban NOA function can be used wherever there is a navigation map.

It is worth mentioning that in the evaluation results of the first batch of vehicles in 2023 published by China Automobile Research Institute, Ideal L9 won a five-star intelligent star rating. In the intelligent safety test, Ideal L9 has the highest score among the tested vehicles and the highest score in IVISTA China Smart Car Index.

Based on positive market feedback, Li wants to give a new high to the second quarter performance guidance in the financial report performance meeting. He pointed out that with the delivery of Ideal L7 Air and Ideal L8 Air in April, Ideal further expanded the product price and the coverage of home users. In the second quarter of the previous year, the delivery volume of vehicles was 76,000 to 81,000, and the estimated total revenue was 24.22 billion yuan to 25.86 billion yuan.

It is reported that the first pure electric vehicle in LI will be released in the fourth quarter of 2023. The goal is to make high-voltage pure electric vehicles achieve similar prices as extended-range vehicles, and at the same time obtain similar gross profit margins, which will also depend on the ideal layout of the supply chain.

In view of the future market competition situation, Li Xiang said, first, the market share is the most important, so the core goal of LI in the second quarter is to increase the market share of NEV market above 200,000 yuan in the first quarter from 11% to 13%; Secondly, there is no consideration of reducing the price in LI at present, because when making long-term planning and pricing, the company has set the price at a competitive price in the corresponding range according to the level and size of different models, and both upward and downward fluctuations of the price will be problematic.

Recently, LI also officially released the "Dual Energy Strategy", and plans to form a product layout of "1 super flagship model +5 extended-range electric vehicles +5 high-voltage pure electric vehicles" for more than 200,000 markets in 2025.

At the same time, LI continues to expand the network layout and accelerate the upgrading of store quality. Since late June 2022, LI has expanded or optimized nearly 50 existing stores. As of April 30, 2023, LI has 302 retail centers nationwide, covering 123 cities; There are 318 after-sales maintenance centers and authorized car body panel spraying centers, covering 222 cities.

This article is an exclusive manuscript of Observer. It cannot be reproduced without authorization.